Are you looking for the ultimate financial security? Then it’s high time to consider both income and life insurance! While many people view these two types of insurance policies as separate entities, they actually work together to provide comprehensive coverage. Whether you’re seeking protection against unexpected illness or unfortunate accidents, understanding the importance of combining income and life insurance can help safeguard your finances in times of uncertainty. Keep reading to discover why these two insurances are a dynamic duo for achieving financial peace of mind.

What is income insurance?

Income insurance is a type of insurance that helps to protect your income in the event that you are unable to work due to an injury or illness click here for new casinos online. It can help to replace a portion of your lost income and help you to meet your financial obligations. Income insurance can be an important part of your financial security plan.

What is life insurance?

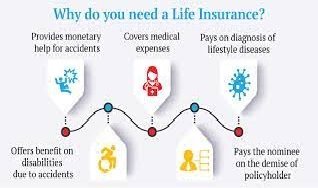

When it comes to financial security, many people think of income insurance first. However, life insurance is just as important – if not more so. Here’s why:

First, life insurance provides a death benefit that can help your loved ones cover expenses if you die prematurely. This can be especially important if you are the primary breadwinner in your household.

Second, life insurance can be used as a retirement savings tool. Many policies offer cash value accumulation, which you can access during retirement. This can provide a valuable source of supplemental income in retirement.

Finally, life insurance can provide peace of mind in knowing that you and your loved ones are taken care of financially if something happens to you. No one likes to think about their own death, but it’s an important part of financial planning.

Consider both income and life insurance when planning for your financial security. Both types of coverage are important and can provide vital protection for you and your family.

How do they work together?

If you’re like most people, you probably think of life insurance and income insurance as two separate things. But in reality, they work together to provide you with financial security.

Here’s how it works: Life insurance provides a death benefit that can help your family maintain their standard of living if you die prematurely. Income insurance, on the other hand, replaces a portion of your lost earnings if you’re unable to work due to an injury or illness.

So, if you’re the primary breadwinner for your family, it’s important to have both types of coverage casino games real money. That way, if something happens to you, your family will still be able to financially survive.

Who needs both income and life insurance?

There are a lot of people out there who think that they only need life insurance or income insurance, but not both. However, there are actually many people who need both types of insurance for financial security.

Here are some examples of people who need both income and life insurance:

1. People with young families. If you have young children, then you need to make sure that they will be taken care of financially if something happens to you. Having both life insurance and income insurance will ensure that your family is taken care of no matter what happens to you.

2. Business owners. If you own a business, then it is important to have both life and income insurance. This way, if something happens to you, your business will still be able to continue operating and your family will still have an income.

3. People with high-risk jobs. If you have a job that is considered high-risk, then you should definitely have both life and income insurance. This way, if something happens to you, your family will still be taken care of financially.

4. Anyone who wants financial security in case of an unexpected death or disability. No one knows what can happen in the future, so it’s always good to be prepared for anything. Having both life and income insurance gives you and your family peace of mind knowing that you are covered no matter what happens down the road.

How much should you get?

When deciding how much income and life insurance you need, there are a few things to consider. Your monthly expenses, your debt, and your dependents all play a role in how much coverage you should have.

Your monthly expenses include your mortgage or rent, car payment, utilities, food, and other necessary costs. Add up all of these costs and multiply them by 12 to get your yearly expenses. This is the base amount of income you would need to replace if you were no longer able to work.

Your debt also needs to be taken into account when deciding how much income replacement you need. If you have a mortgage or other loans that would need to be paid off in the event of your death, make sure to factor that into your decision.

Finally, consider your dependents. If you have children or other family members who rely on you financially, you’ll want to make sure they are taken care of in the event of your death. Calculate how much money they would need each month to cover their expenses and add that to your total income replacement needs.

What are some other benefits of having both income and life insurance?

There are many benefits to having both income and life insurance. For one, it provides financial security in the event of your death. If you have dependents, they will be taken care of financially if you die. Additionally, life insurance can be used to cover final expenses, such as funeral costs and outstanding debts.

Income insurance, on the other hand, can help replace your lost wages if you become disabled and are unable to work. This can help ensure that you and your family maintain your standard of living. Additionally, income insurance can provide funding for retraining or rehabilitation if you are able to return to work after a disability.